Name/Title

Instructions to taxpapers pamphletEntry/Object ID

1986.18.19Scope and Content

One fold pamphlet issued by the Dominion of Canada Income Tax, R.W. Breadner, Commissioner of Taxation. It provides guidance to taxpayers on ammendments to the Income War Tax Act assented to Parliament the 15th June, 1926.

Contains three pages of text and back page blank.

Transcription of artifact is as follows:

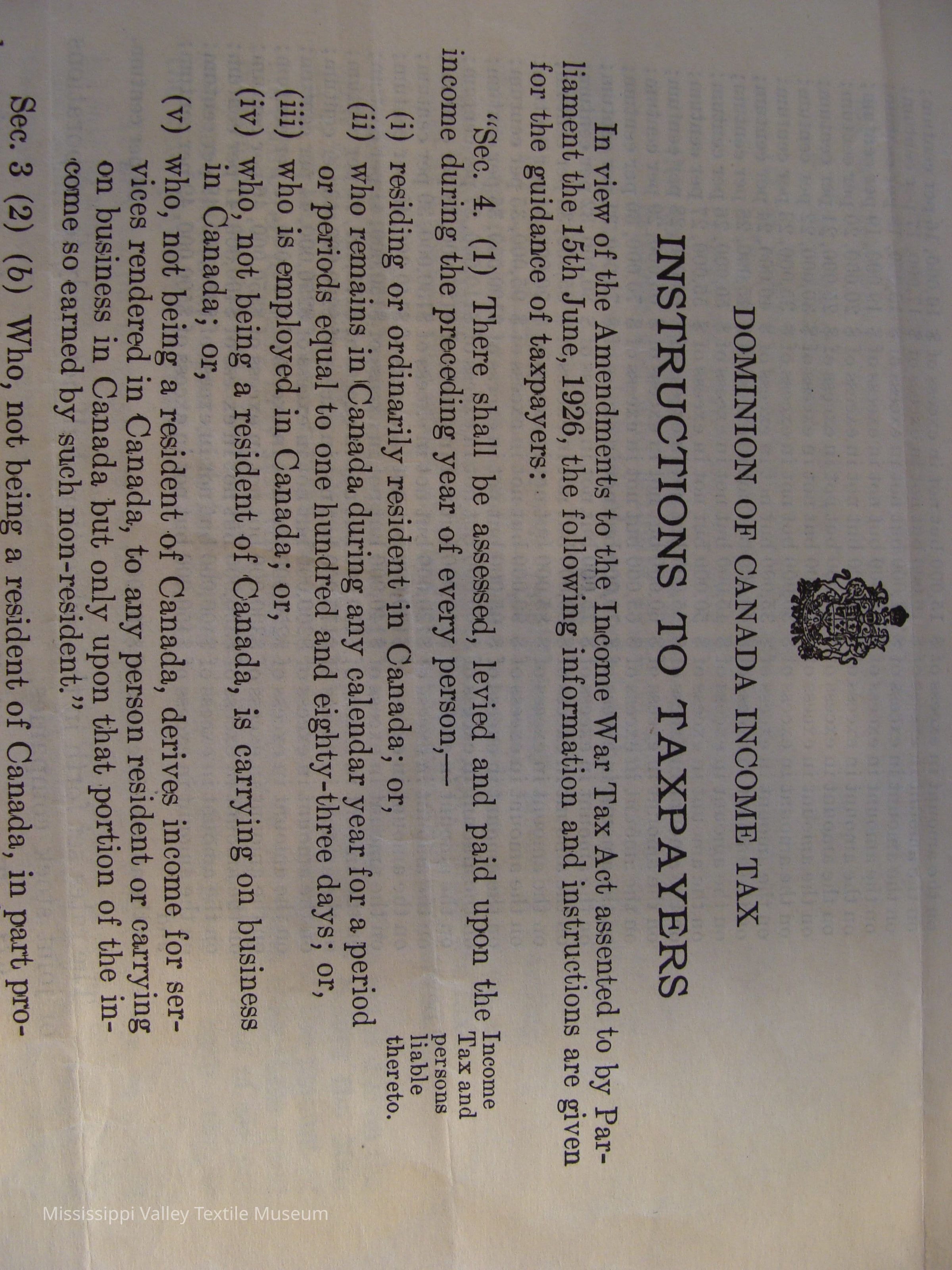

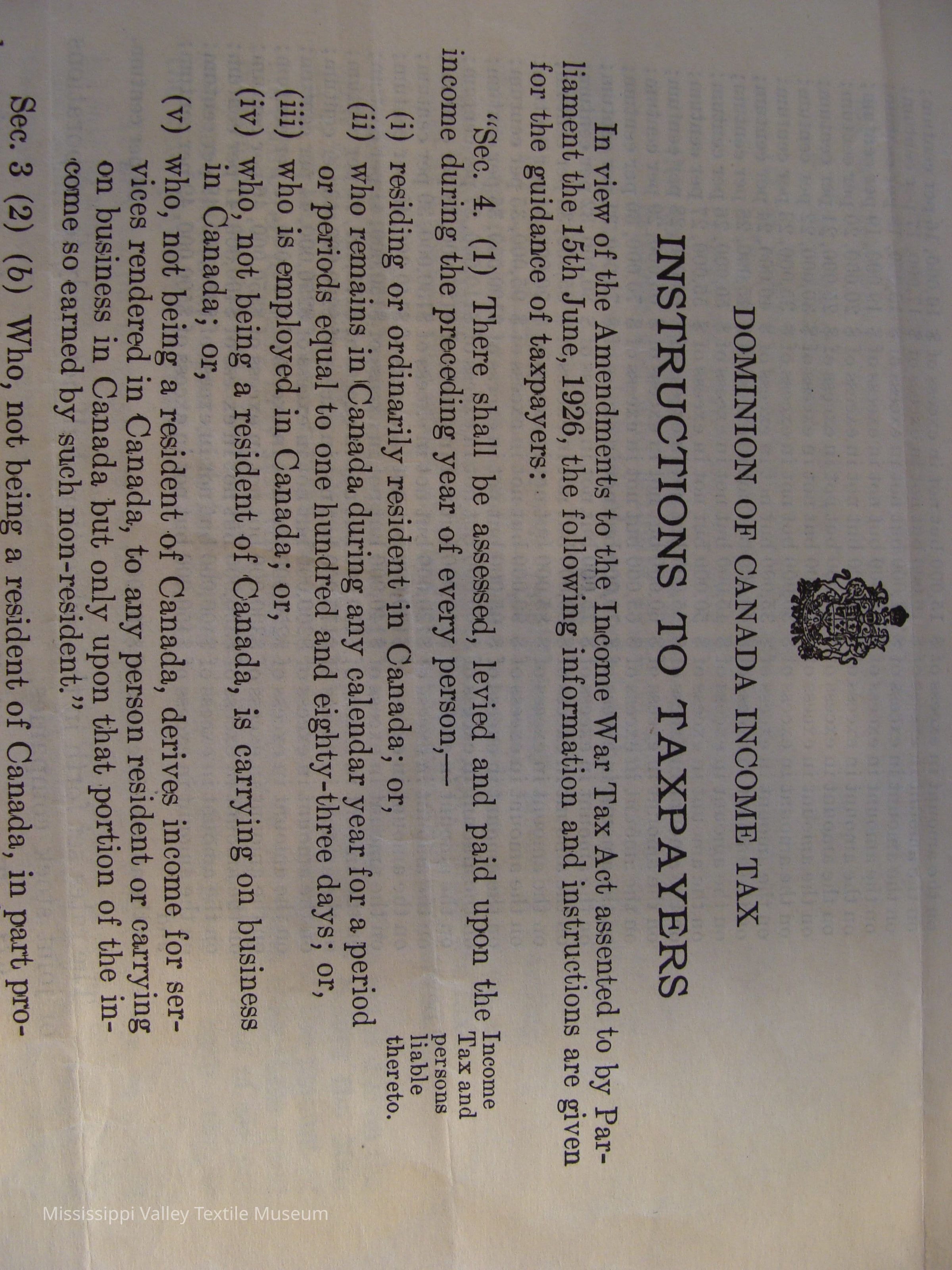

DOMINION OF CANADA INCOME TAX

INSTRUCTIONS TO TAXPAYERS

In view of the Amendments to the Income War Tax Act assented to by Parliament the 15th June, 1926, the following information and instructions are given for the guidance of taxpayers:

“Sec. 4. (1) There shall be assessed, levied and paid upon the Income Tax and persons liable thereto income during the preceding year of every person,-

(i) residing or ordinarily resident in Canada; or,

(ii) who remains in Canada during any calendar year for a period or periods equal to one hundred and eighty-three days; or,

(iii) who is employed in Canada; or,

(iv) who, not being a resident of Canada, is carrying on business in Canada; or,

(v) who, not being a resident of Canada, derives income for services rendered in Canada, to any person resident or carrying on business in Canada but only upon that portion of the income so earned by such non-resident.”

Sec. 3 (2) (b) Who, not being a resident of Canada, in part produces, grows, mines, creates, manufactures, fabricates, improves, packs, preserves or constructs anything within Canada and exports the same without sale prior to the export thereof.

Sec. 3 (3) (b) (1) Who, not being a resident of Canada, solicits orders or offers anything for sale in Canada through an agent or employer whether the resulting contract is completed within or without Canada.

(2) Who, not being a resident of Canada, leases anything or receives a royalty or similar payment for anything used or sold in Canada.

Such persons shall pay “the following taxes upon the amount of Rates of Tax income in excess of the exemptions hereinafter provided,-

On the first $2,000 or any portion thereof, 2 per centum;

On the amount in excess of $ 2,000 but not in excess of $ 3,000, 3 per centum;

On the amount in excess of $ 3,000 but not in excess of $ 4,000, 4 per centum;

On the amount in excess of $ 4,000 but not in excess of $ 5,000, 5 per centum;

On the amount in excess of $ 5,000 but not in excess of $ 6,000, 6 per centum;

On the amount in excess of $ 6,000 but not in excess of $ 7,000, 7 per centum;

On the amount in excess of $ 7,000 but not in excess of $ 8,000, 8 per centum;

On the amount in excess of $ 8,000 but not in excess of $ 9,000, 9 per centum;

On the amount in excess of $ 9,000 but not in excess of $ 10,000, 10 per centum;

On the amount in excess of $ 10,000 but not in excess of $ 11,000, 11 per centum;

On the amount in excess of $ 11,000 but not in excess of $ 12,000, 12 per centum;

On the amount in excess of $ 12,000 but not in excess of $ 13,000, 13 per centum;

On the amount in excess of $ 13,000 but not in excess of $ 14,000, 14 per centum;

On the amount in excess of $ 14,000 but not in excess of $ 15,000, 15 per centum;

31650

On the amount in excess of $ 15,000 but not in excess of $ 16,000, 16 per centum;

On the amount in excess of $ 16,000 but not in excess of $ 17,000, 17 per centum;

On the amount in excess of $ 17,000 but not in excess of $ 18,000, 18 per centum;

On the amount in excess of $ 18,000 but not in excess of $ 19,000, 19 per centum;

On the amount in excess of $ 19,000 but not in excess of $ 20,000, 20 per centum;

On the amount in excess of $ 20,000 but not in excess of $ 25,000, 21 per centum;

On the amount in excess of $ 25,000 but not in excess of $ 30,000, 22 per centum;

On the amount in excess of $ 30 ,000 but not in excess of $ 35,000, 23 per centum;

On the amount in excess of $ 35 ,000 but not in excess of $ 40,000, 24per centum;

On the amount in excess of $ 40, 000 but not in excess of $ 45,000, 25 per centum;

On the amount in excess of $ 45,000 but not in excess of $ 50,000, 26 per centum;

On the amount in excess of $ 50,000 but not in excess of $ 55,000, 27 per centum;

On the amount in excess of $ 55,000 but not in excess of $ 60,000, 28 per centum;

On the amount in excess of $ 60 ,000 but not in excess of $ 65,000, 29 per centum;

On the amount in excess of $ 65,000 but not in excess of $ 70,000, 30 per centum;

On the amount in excess of $ 70,000 but not in excess of $ 75,000, 31 per centum;

On the amount in excess of $ 75,000 but not in excess of $ 80,000, 32 per centum;

On the amount in excess of $ 80,000 but not in excess of $ 85,000, 33 per centum;

On the amount in excess of $ 85,000 but not in excess of $ 90,000, 34 per centum;

On the amount in excess of $ 90,000 but not in excess of $ 95,000, 35 per centum;

On the amount in excess of $ 95,000 but not in excess of $ 100,000, 36 per centum;

On the amount in excess of $ 100,000 but not in excess of $ 110,000, 37 per centum;

On the amount in excess of $ 110,000 but not in excess of $ 120,000, 38 per centum;

On the amount in excess of $ 120,000 but not in excess of $ 130,000, 39 per centum;

On the amount in excess of $ 130,000 but not in excess of $ 140,000, 40 per centum;

On the amount in excess of $ 140,000 but not in excess of $ 150,000, 41 per centum;

On the amount in excess of $ 150,000 but not in excess of $ 175,000, 42 per centum;

On the amount in excess of $ 175,000 but not in excess of $ 200,000, 43 per centum;

On the amount in excess of $ 200,000 but not in excess of $ 250,000, 44 per centum;

On the amount in excess of $ 250,000 but not in excess of $ 300,000, 45 per centum;

On the amount in excess of $ 300,000 but not in excess of $ 350,000, 46 per centum;

On the amount in excess of $ 350,000 but not in excess of $ 400,000, 47 per centum;

On the amount in excess of $ 400,000 but not in excess of $ 450,000, 48 per centum;

On the amount in excess of $ 450,000 but not in excess of $ 500,000, 49 per centum;

And

On the amount in excess of $500,000, 50 per centum.

The rates set forth in this subsection shall not apply to corporations or joint stock companies.

“(1A) Taxpayers shall be entitled to the following exemptions --

Statutory “ (a) Threethousand dollars in the case of a married person or house holder, (as exemptions. described below) or any other person who has dependent upon him any of the following persons:--

(i) a parent or grandparent;

(ii) a daughter or sister;

(iii) a son or brother under twenty-one years of age who is dependent upon the taxpayer for support

Incapable of self-suppor on account of a mental or physical infirmity,

“(b) fifteen hundred dollars in the case of other persons , and

“(c) five hundred dollars for each child under eighteen years of age who is dependent upon the taxpayer for support.

Incomes of

Husband and wife

“(1B) where a husband and wife have each a separate income in excess of fifteen hundred dollars , each shall receive an exemption of fifteen hundred dollarsin lieu of the exemption set forth in paragraph (a) of the immediately preceding subsection.

“ (1c) The exemption for each dependent child may be taken by either parent under arrangement between themselves, In the event of any dispute arising between them, then the said exemption or exemptions shall be allotted to the father of the said child or children.”

4. (2) “Corporations and joint stock companies, no matter how created or organized, shall pay nine per centum upon income exceeding two thousand dollars.” Corporation Tax.

2. “(n) ’householder’ means, Householder.

(i) an individual who at his own and sole expense maintains a self-contained domestic establishment, (as described below) employing therein on full time a housekeeper or servant; or,

(ii) an individual who maintains a self-contained domestic establishment and who actually supports and maintains therein one or more individuals connected with him by blood relationships , marriage or adoption.

“(o) ‘self-contained domestic establishment ‘ means a dwelling house, apartment or other similar place of residence, containing at least two bedrooms, in which residence amongst, other things the tax player as a general rule seeps and has his meals prepared and served.”

Every taxpayer must estimate the tax payable by him. The tax is due on the 30th April, in each year. Every taxpayer shall send on or before the 30th April, in each year, with his return,not less than one quarter of the amount of his estimated tax, and may pay the balance, if any in not more than three equal bi-monthly instalments thereafter, together with interest, at the rate of six per centum per annum upon each instalment from the 30th April in each year, to the time payment is made.

If any taxpayer pays less than one quarter of his estimated tax, or should he fail to make any payment on or before the 30th April, in each year, or at the time when any instalment should be paid, he shall pay additional interest, at the rate of four per centum per annum upon the deficiency from the date of default to the date of payment.

Any additional tax found due over the estimated amount shall be paid within one month from the date of mailing of the Notice of Assessment together with interest at the rate of six per centum per annum from the 30th April. If payment of the additional amount of tax is not made within the said one month, additional interest at the rate of four per centum per annum shall be payable from the date of default until payment is made.

If the statutory exemption of three thousand dollars is claimed the taxpayer must complete file with his Income Tax return one of the following forms-

From T. 1C -- claim as a house holder,

Form T. 1D -- claim as a married person whose husband’s wife’s income was not more than fifteen hundred dollars in each year on which exemption of $3,000 is claimed.

Form T. 1E -- claim for supporting dependents.

R.W.BREADNER

Commissioner of Taxation.

____________________________________________________________

OTTAWA: Printed by F.A. ACLAND, Printer to the King’s Most Excellent Majesty, 1927.Cataloged By

Paul, NancyLexicon

LOC Thesaurus for Graphic Materials

Income taxes, WarArchive Details

Date(s) of Creation

1927Archive Notes

Date(s) Created: Ottawa: Printed by F.A. AcLand, Printer to the King's Most Excellent Majesty, 1927Location

Date

November 7, 2023Location

Container

Archive Box 1Shelf

Shelf 1Room

Collections RoomBuilding

M.V.T.M.Category

PermanentCategory

PermanentGeneral Notes

Note

Status: OK

Status By: Whit, Elizabeth

Status Date: 2016-08-07Created By

admin@catalogit.appCreate Date

June 9, 1986Updated By

admin@catalogit.appUpdate Date

November 11, 2023